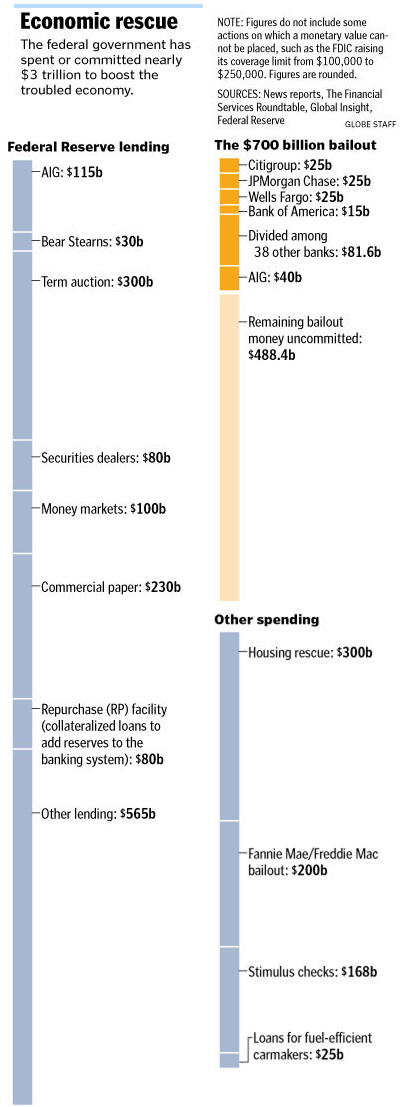

Chart below provides data for input to OrgScope map of Federal Reserve Lending and Other funds being expended. See Boston Globe article by Ross Kerber and Robert Weisman, "Bailout retooled to boost lending," on 13 November 2008. Chart is from that article.

Total (Estimated) |

|

|||

Additional Spending - 24 November |

||||

| Citigroup Inc. | $20,000,000,000 | |||

| Citigroup Inc. - Loan Guarantees | $306,000,000,000 | |||

Investments - 28 October 2008 |

||||

| Bank of America Corporation | $15,000,000,000 | |||

| Bank of New York Mellon Corporation | $3,000,000,000 | |||

| Citigroup Inc. | $25,000,000,000 | |||

| The Goldman Sachs Group, Inc. | $10,000,000,000 | |||

| JPMorgan Chase & Co. | $25,000,000,000 | |||

| Morgan Stanley | $10,000,000,000 | |||

| State Street Corporation | $2,000,000,000 | |||

| Wells Fargo & Company | $25,000,000,000 | |||

| Merrill Lynch & Co., Inc. *Deferred | $10,000,000,000 | |||

Investments - 14 November 2008 |

||||

| Bank of Commerce Holdings | $17,000,000 | |||

| 1st FS Corporation | $16,369,000 | |||

| UCBH Holdings, Inc. | $298,737,000 | |||

| Northern Trust Corporation | $1,576,000,000 | |||

| SunTrust Banks, Inc. | $3,500,000,000 | |||

| Broadway Financial Corporation | $9,000,000 | |||

| Washington Federal Inc. | $200,000,000 | |||

| BB&T Corp. | $3,133,640,000 | |||

| Provident Bancshares Corp. | $151,500,000 | |||

| Umpqua Holdings Corp. | $214,181,000 | |||

| Comerica Inc. | $2,250,000,000 | |||

| Regions Financial Corp. | $3,500,000,000 | |||

| Capital One Financial Corporation | $3,555,199,000 | |||

| First Horizon National Corporation | $866,540,000 | |||

| Huntington Bancshares | $1,398,071,000 | |||

| KeyCorp | $2,500,000,000 | |||

| Valley National Bancorp | $300,000,000 | |||

| Zions Bancorporation | $1,400,000,000 | |||

| Marshall & Ilsley Corporation | $1,715,000,000 | |||

| U.S. Bancorp | $6,599,000,000 | |||

| TCF Financial Corporation | $361,172,000 | |||

AIG Investment |

||||

| AIG | $40,000,000,000 | |||

Federal Reserve Lending |

||||

| AIG | $115,000,000,000 | |||

| Bear Stearns | $30,000,000,000 | |||

| Term Auction | $300,000,000,000 | |||

| Security Dealers | $80,000,000,000 | |||

| Money Markets | $100,000,000,000 | |||

| Commercial Paper | $230,000,000,000 | |||

| Repurchase Facility | $80,000,000,000 | |||

| Other Lending | $565,000,000,000 | |||

Other Spending |

||||

| Housing Rescue | $300,000,000,000 | |||

| Fannie Mae/Freddie Mac | $200,000,000,000 | |||

| Stimulus Checks | $168,000,000,000 | |||

| Car Makers for fuel-efficiency | $25,000,000,000 | |||

Data for rescue funds managed by US Department of the Treasury based on OFS press releases and their Transaction Report on 17 November 2008